The need for financing is one thread that commonly ties everyone’s aspirations. It’s especially the case with individuals with mobility challenges or those facing medical conditions.

While state-of-the-art mobility aids play a pivotal role in their daily tasks, the costs of these devices can be substantial. And with this, assessing the right medication and medical equipment remains a dream for most people.

We delve into the world of medical equipment financing and explore funding solutions. We aim to enhance the quality of life through accessible and affordable financing.

Importance of Accessible Financing for Medical Equipment

The importance of accessible financing for medical equipment cannot be overstated in this modern healthcare era. Accessing proper medical equipment is a game changer in unlocking better quality of life.

Here are some reasons why it’s critical to access finance for medical equipment.

Medical Equipment is Expensive

Mobility devices are the bridge that connects people with mobility challenges to independence and comfort. But this bridge often comes with an expensive price tag.

A lot of work and resources are normally deployed to ensure the equipment serves its intended purposes. And unfortunately, this cost is ultimately passed on to consumers.

These hefty price tags become a financial burden, making it difficult for individuals and their families to access desperately needed equipment.

Limited Financial Resources

Medical bills and ongoing healthcare expenses can be overwhelming. Add the prospect of buying expensive medical equipment, making it impossible for individuals and families to afford these.

Forgoing or delaying this equipment because of financial constraints leads to a decline in the patient’s quality of life.

Mobility Paradise’s Medical Equipment Financing Solution

At Mobility Paradise, our mission is to move you toward freedom and independence, including helping you afford our mobility aid equipment. We understand the importance and transformative power of the equipment in enhancing the quality of life.

Because of this, we have partnered with Bread PayTM – a trusted name in consumer financing—to provide users with a reasonable financing program.

This joining of forces created the Pay Over Time Program—a flexible financing option that helps customers meet their needs and enables them to access the necessary equipment.

The Pay Over Time Program

Our partnership with Bread PayTM brought along the Pay Over Time program. The program is designed to meet the diverse needs of our customers. Here’s what it entails.

Flexible Monthly Plans

Pay Over Time allows customers to choose different flexible monthly payment plans. You buy now and pay for your purchase over time at competitive interest rates.

This program allows you to choose a financial agreement that aligns with your budget and financial circumstances. This is much better than one lump sum upfront payment.

No Prepayment Penalties

The Pay Over Time program has no hidden fees or prepayment penalties. We believe in straightforward financing, meaning no hidden fees or surprises exist.

You pay for your purchase monthly and prepay any time without penalty. You can confidently plan your budget without having to worry about unexpected costs.

We are committed to transparency, which means being clear with our terms and conditions, including repayment schedules and interest rates. We aim to help you make informed decisions about your financing.

Easy Application

Who wants to intimidate their customers with a tedious and complex application process? Definitely not us. Our Pay Over Time Program application is a quick and easy one.

You can apply for financing directly through our website and complete it from the comfort of your sofa. When done, our team will work to give a quick approval on your application. Most of the time, we make instant decisions (within seconds) without the obligation to buy.

We want you to move forward with your purchase without any delays.

Security and Privacy

We can assure you that your data is safe with us. We have employed industry-standard security measures, including encrypting your information to safeguard your data.

Exploring Affordable Monthly Plans

Our program gives you a range of financing plans to pick one that suits your unique financial needs and circumstances. Here are deeper details of these plans.

Different Financing Plans

Our financing plans, together with Bread PayTM, are tailored to different needs. Before choosing a plan,

- Assess your budget and determine how much you can comfortably allocate to each monthly payment.

- Review the plan details, taking a closer look at the interest rates, monthly payment amounts, and the length of the repayment plan.

- Settle for the best option, one that aligns with your budget. Consider both the short- and long-term impact this has on your finances.

You are good to go!

The Application Process

Here is a step-by-step guide to applying for the Pay Over Time program. It is quick, user-friendly, and hassle-free!

Step 1: Select Your Product

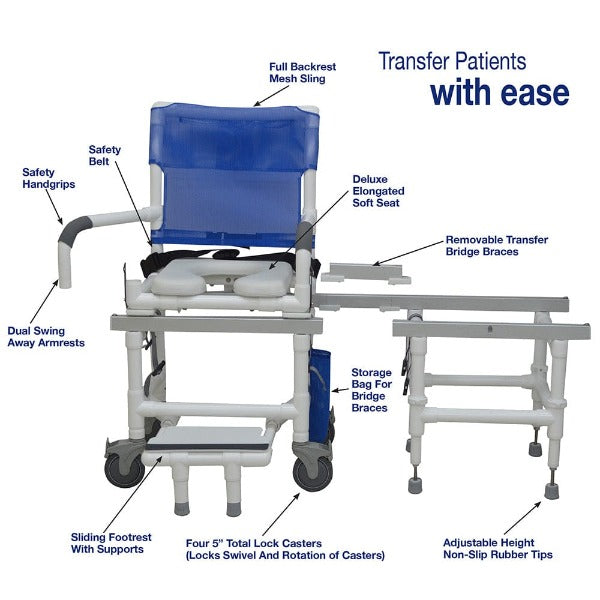

The first step is to choose the mobility equipment you need from our wide range of products, whether it is a mobility scooter, electric wheelchair, or patient care equipment.

Add your selected equipment to the shopping cart on our website.

Step 2: Choose Bread Pay

Proceed to check out when you are ready to make your purchase. You’ll need to fill in your personal information. This includes:

- Full names

- Company (optional)

- Address

- Apartment, suite (optional)

- City

- State

- ZIP code

- Phone

Once done, you’ll be directed to the payment page. Select Pay Over Time with Bread Pay.

Click Pay Now.

Click Get Started on the next page, then enter your email address.

Enter your mobile phone number for verification purposes, then click Agree & Submit.

Remember, to be eligible for the program,

- You must be of legal contract age (18+ Years).

- You must have a valid U.S. residential address.

- Since we perform a credit check, it may be necessary that you have a satisfactory credit history.

Step 3: Complete the Application

After submitting your application, Bread PayTM will provide an instant decision (most of the time) on whether your application for medical equipment financing has been approved.

If it’s approved, you will be presented with your plan’s terms and conditions. It will include details such as the monthly payment account, length or repayment term, and interest rate.

Peruse the terms, reviewing them carefully. Accept the offer when you are ready.

Congratulations! You have completed your purchase. The rest is for us to start shipping your mobility equipment.

Tips for Financing Medical Equipment

Here are a few tips to help you manage your finances and acquire medical equipment.

Renting Vs. Buying

You may consider renting the medical equipment instead of buying it. This can be a more cost-effective option, especially for short-term needs. An excellent example is when you are recovering from surgery, and you’ll most likely not need the equipment after that.

In most cases, renting is a cheaper and more budget-friendly option to buy.

Refurbished Equipment

Another viable option would be to consider getting used or refurbished equipment. Medical equipment that has been used gently is generally more affordable than new equipment.

Long-term Costs

Finally, evaluate the long-term costs of equipment. Consider its replacement parts, repairs, and maintenance. Choose equipment that will balance the upfront cost with expenses.

Get Your Financing Today

At Mobility Paradise, we believe everyone should be able to access medical equipment and improve their lives. We make this dream possible with our partnership with Bread PayTM.

Contact us today, and we’ll help you with any assistance. Our experts will help you explore your options, and together, we can find you the right plan for your needs. We are excited to partner and join you in your journey to realizing enhanced mobility and freedom.